The 7-Second Trick For Estate Planning Attorney

The 7-Second Trick For Estate Planning Attorney

Blog Article

The Best Guide To Estate Planning Attorney

Table of ContentsTop Guidelines Of Estate Planning AttorneyAll about Estate Planning AttorneyGetting The Estate Planning Attorney To WorkThe Single Strategy To Use For Estate Planning AttorneyNot known Details About Estate Planning Attorney

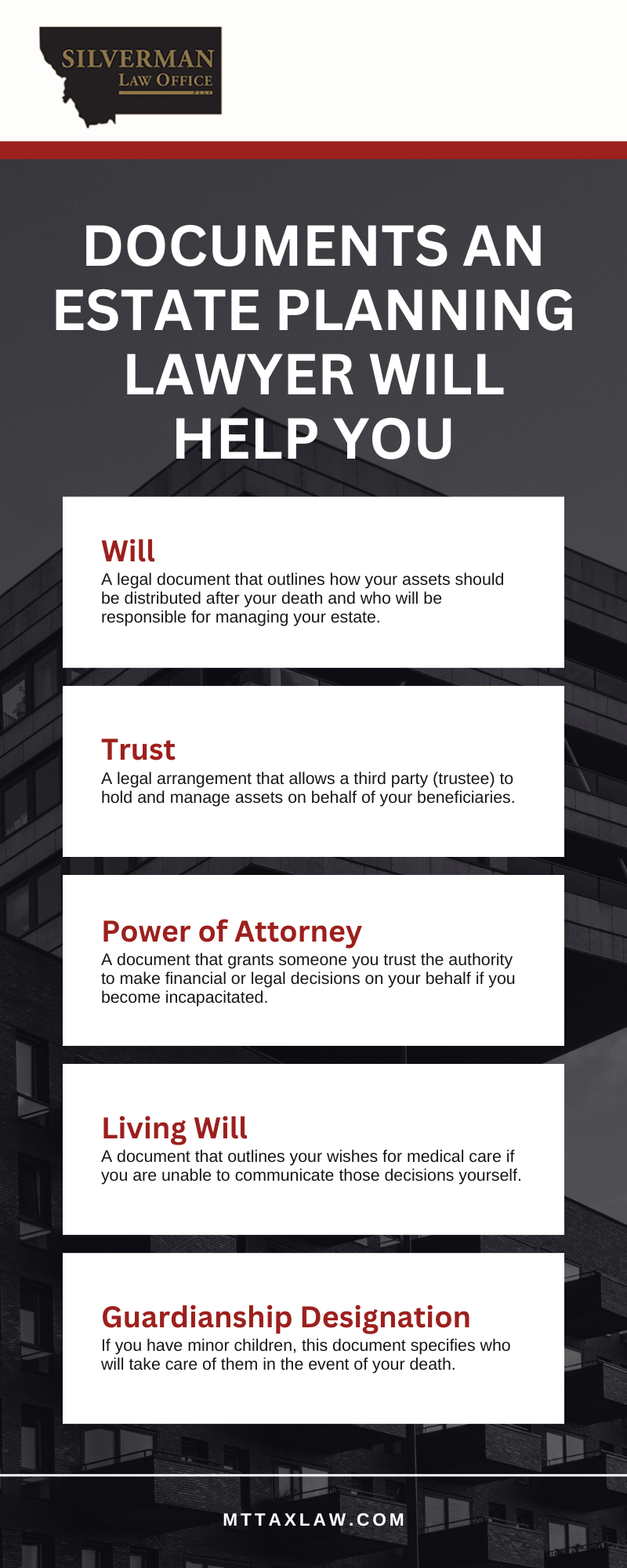

Encountering end-of-life choices and securing family riches is a challenging experience for all. In these challenging times, estate planning attorneys aid individuals prepare for the distribution of their estate and establish a will, trust fund, and power of attorney. Estate Planning Attorney. These lawyers, likewise referred to as estate law lawyers or probate lawyers are qualified, experienced specialists with a comprehensive understanding of the government and state laws that put on how estates are inventoried, valued, dispersed, and strained after death

The intent of estate preparation is to properly plan for the future while you're sound and qualified. An effectively ready estate plan outlines your last wishes precisely as you desire them, in the most tax-advantageous manner, to stay clear of any kind of inquiries, mistaken beliefs, misconceptions, or disputes after death. Estate planning is a field of expertise in the lawful career.

How Estate Planning Attorney can Save You Time, Stress, and Money.

These lawyers have a thorough understanding of the state and federal regulations associated with wills and trust funds and the probate process. The duties and responsibilities of the estate lawyer may consist of therapy clients and composing legal documents for living wills, living depends on, estate plans, and inheritance tax. If needed, an estate preparation attorney might participate in litigation in probate court on behalf of their customers.

According to the Bureau of Labor Stats, the work of lawyers is anticipated to grow 9% in between 2020 and 2030. About 46,000 openings for lawyers are projected every year, typically, over the decade. The course to becoming an estate planning lawyer is comparable to other practice areas. To enter law institution, you should have a bachelor's degree and a high GPA.

Ideally, take into consideration possibilities to obtain real-world job experience with mentorships or internships connected to estate preparation. Doing so will give you the skills and experience to gain admittance right into law institution and connect with others. The Law College Admissions Test, or LSAT, is a crucial part of relating to legislation college.

Typically, the LSAT is offered four times per year. It's crucial to plan for the LSAT. Most prospective trainees begin examining for the LSAT a year beforehand, commonly with a study hall or tutor. The majority of law pupils use for law institution during the autumn semester this page of the final year of their undergraduate studies.

Fascination About Estate Planning Attorney

On average, the annual salary for an estate my response attorney in the United state is $97,498. Estate planning attorneys can function at large or mid-sized legislation companies or branch out on their own with a solo method.

This code relates to the limitations and guidelines enforced on wills, counts on, and various other lawful files pertinent to estate planning. The Uniform Probate Code can vary by state, yet these legislations govern different elements of estate planning and probates, such as the creation of the count on or the lawful legitimacy of wills.

Are you unpredictable about what profession to seek? It is a tricky concern, and there is no very easy answer. You can make some considerations to assist make the choice less complicated. Initially, take a seat and note the points you are proficient at. What are your staminas? What do you take pleasure in doing? Once you have a checklist, you can tighten down your options.

It entails determining just how your properties will certainly be dispersed and that will manage your experiences if you can no more do so yourself. Estate preparation is a needed component of monetary planning and must be performed with the aid of a certified specialist. There are a YOURURL.com number of elements to take into consideration when estate preparation, including your age, health and wellness, financial circumstance, and household circumstance.

Things about Estate Planning Attorney

If you are young and have couple of ownerships, you may not need to do much estate preparation. Nevertheless, if you are older and have much more prized possessions, you need to think about dispersing your assets among your successors. Wellness: It is a crucial element to take into consideration when estate planning. If you remain in excellent health and wellness, you may not need to do much estate preparation.

If you are wed, you should take into consideration exactly how your assets will be dispersed between your spouse and your successors. It aims to make sure that your assets are dispersed the way you want them to be after you die. It consists of taking into consideration any kind of tax obligations that may need to be paid on your estate.

All about Estate Planning Attorney

The attorney likewise aids the people and families produce a will. A will is a lawful document mentioning just how individuals and households want their assets to be dispersed after death. The lawyer also helps the people and households with their trust funds. A trust fund is a lawful record permitting people and households to transfer their possessions to their beneficiaries without probate.

Report this page